Top Defi Dogs YFI, LEND, and UNI Correct Nearly 20%

Bitcoin, Ethereum, and other major crypto assets all plummeted over the last several hours, but few have dropped as hard as top DeFi tokens, YFI, LEND, and UNI. Why have these once soaring altcoins plunged so hard and is there more downside ahead? Yearn-Ing For The DeFi Trend To Continue After 20% Pullback For a […]

Bitcoin, Ethereum, and other major crypto assets all plummeted over the last several hours, but few have dropped as hard as top DeFi tokens, YFI, LEND, and UNI.

Why have these once soaring altcoins plunged so hard and is there more downside ahead?

Yearn-Ing For The DeFi Trend To Continue After 20% Pullback

For a while there, it seemed like nothing could put a damper on the flaming hot DeFi trend. Coin after coin exploded in value as interest poured into each new DeFi project.

Some of the most successful highlights of the DeFi space in recent weeks, are Yearn.Finance (YFI), Aave (LEND), and Uniswap (UNI).

Related Reading | Yearn.Finance (YFI) Flies 15% Percent From Local Price Floor, Fractal Targets $60K+

LEND has had some of the strongest year over year performance out of any cryptocurrency, while YFI is now far more expensive than Bitcoin itself.

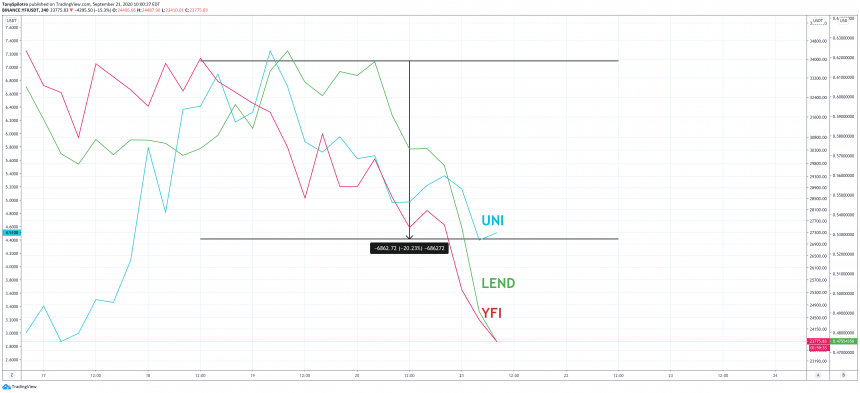

UNI is the newest of the bunch, but that hasn’t stopped it from first debuting as the crypto version of the stimulus check at $3 per token, then in just days more than doubled in value to a high of over $7. Now, it’s at under $5 after a more than 20% collapse across just about all DeFi tokens.

But what did these altcoins crash much harder than Bitcoin and Ethereum, and other top cryptos?

LENDUSD Versus UNIUSDT Versus YFIUSD Chart Comparison | Source: TradingView

Why Have YFI, LEND, and UNI Fallen So Hard Compared To Bitcoin and Ethereum?

The crypto market – and even the greater financial market – is a sea of red today after the dollar index bounced hard. The DXY recovering has hit Bitcoin and other top crypto assets hard, even stocks, metals, and more.

The dollar’s recovery is likely investors derisking into a safe haven asset with stability to avoid any election-related volatility.

Related Reading | Is Uniswap’s UNI The Crypto Version of a Stimulus Check at $3 Per Token?

If investors are derisking en masse and following the advice of top industry analysts, then it isn’t a surprise to see some of the newest, shiniest, and most recently hyped tokens take the brunt of the beating.

These assets are sitting in the fattest profits, just waiting to be taken from paper gains into real ROI. And the reason for Bitcoin and Ethereum holding up better is because some crypto investors prefer to move back into those top cryptos versus taking their capital out of the market and back into cash.

And with many DeFi token investors still in sizable profit, it could only just be the start of a deeper correction.

Featured image from DepositPhotos, Charts from TradingView