Kucoin’s Hack drags Ocean Protocol And Uniswap Into Mud

Kucoin hacker’s fund movement is finally noted two days after the incident. Singapore-based cryptocurrency exchange, Kucoin, suffered a massive hack on the 25th of September, in which, the hackers reportedly drained $150 million worth of digital assets such as Bitcoin, Ethereum, and others. But it wasn’t until the early hours of Sunday that the hacker The post Kucoin’s Hack drags Ocean Protocol And Uniswap Into Mud appeared first on Coingape.

Kucoin hacker’s fund movement is finally noted two days after the incident. Singapore-based cryptocurrency exchange, Kucoin, suffered a massive hack on the 25th of September, in which, the hackers reportedly drained $150 million worth of digital assets such as Bitcoin, Ethereum, and others. But it wasn’t until the early hours of Sunday that the hacker started to move a large amount of ETH as well as ERC20s.

OCEAN Protocal And Uniswap In Spotlight

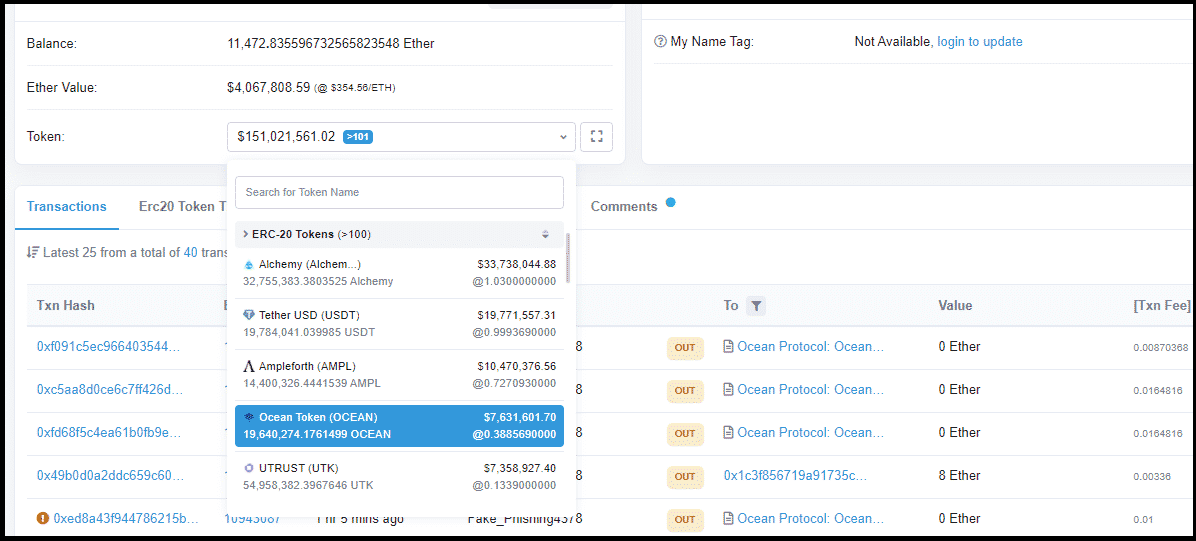

Shortly thereafter, Ocean Protocol notified the community member that around 21 million OCEAN, which is worth over $8.6 million, were also among the stolen funds. This was then followed by the AMM platform pausing Ocean contracts. This incident caused a decline of 5.27% over the last 24-hours and dragged the token’s price to $0.366. The platform further tweeted,

On Sep 25/26, over $150M worth of tokens were stolen from KuCoin exchange, and as part of the theft, over 21M Ocean, worth over $8.6M, were taken. Since yesterday, we have been working to find a solution and ongoingly consulting with KuCoin.

— Ocean Protocol (@oceanprotocol) September 27, 2020

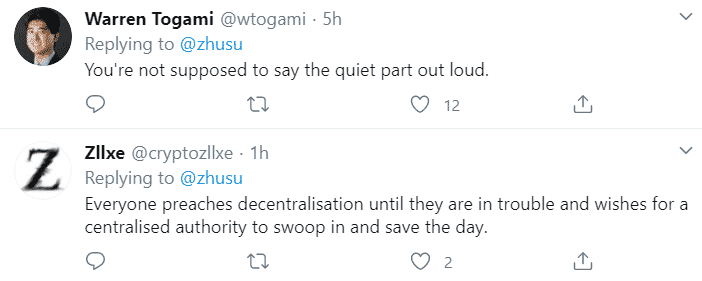

Furthermore, there were questions raised as to why the platform was late in informing the users. But what caught the attention of well-known crypto personalities, however, was the extent of decentralization actually followed by these projects. Along the same line, Su Zhu, the CEO of Three Arrows Capital questioned how freely these “decentralized” platforms were able to pause contracts. His tweet read,

“So it seems there’s a time to talk about decentralizing all the things, and another time to pause contracts bc of a small amount of supply getting hacked. If central actors can freely pause contracts, they can also be forced to do so by regulators in their jurisdictions.”

Further echoing a similar sentiment was Jameson Lopp, the Co-founder, and CTO of Casa who stated,

“The veil of decentralization is lifted when ‘DeFi’ projects freak out about stolen funds being laundered”

Interestingly, the KuCoin hacker started leveraging the DEX platform, Uniswap, to swap from altcoins to Ethereum. This was revealed by Alon Gal, the Chief Technology Officer of cybercrime firm Hudson Rock who further tweeted,

Kucoins hacker begins laundering his $150,000,000.

He started swapping his $OCEAN for ETH via Uniswap.

He already dragged the price down by around 4% in less than an hour and doesn't seem to be slowing down.

Due to low liquidity for this token, he is going to crash it hard. pic.twitter.com/gKcsgpUe3a

— Alon Gal (Under the Breach) (@UnderTheBreach) September 27, 2020

While the latest incident did not have much impact on the cryptocurrency market, in general, but if the swapping continues, DEX giant Uniswap could likely come under the scanner of the regulators.

The post Kucoin’s Hack drags Ocean Protocol And Uniswap Into Mud appeared first on Coingape.