How DeFi ‘Rug Pulls’ Are Becoming the Bane of the Industry

As cryptocurrency markets continue their retreat, DeFi tokens are getting hit particularly hard and investors are growing wary of a rising trend of ‘rug pulls’. In essence, a rug pull is similar to a pump and dump. Tokens are artificially inflated by hype and spurious liquidity, only to be sold off or dumped at a The post How DeFi ‘Rug Pulls’ Are Becoming the Bane of the Industry appeared first on Coingape.

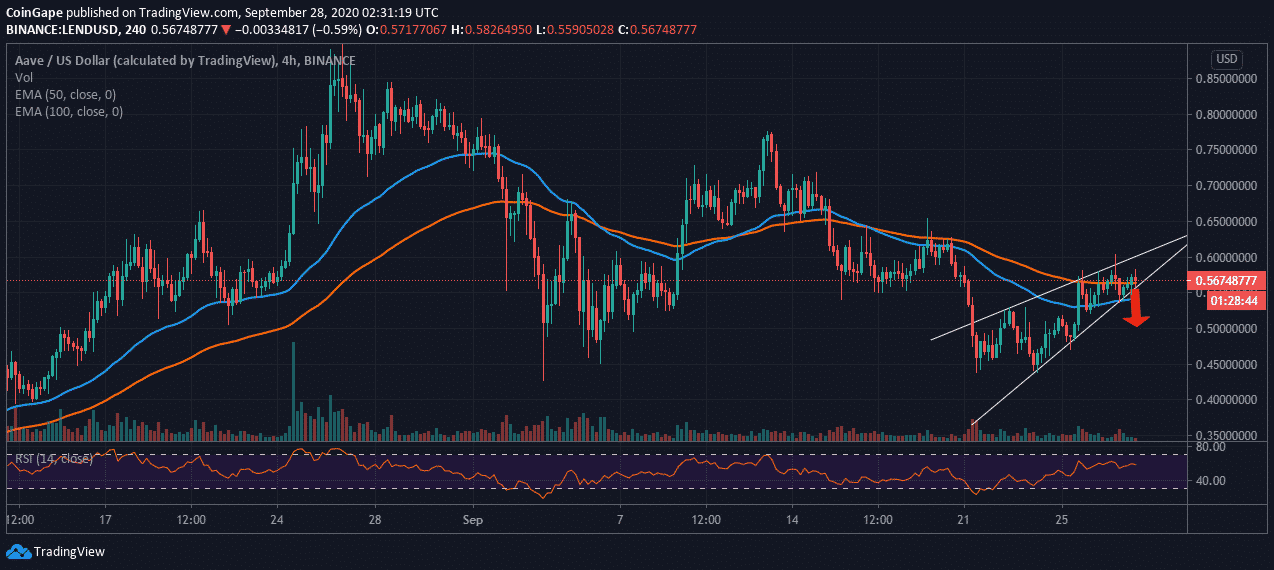

As cryptocurrency markets continue their retreat, DeFi tokens are getting hit particularly hard and investors are growing wary of a rising trend of ‘rug pulls’.

In essence, a rug pull is similar to a pump and dump. Tokens are artificially inflated by hype and spurious liquidity, only to be sold off or dumped at a peak leaving the latecomers out of pocket.

This has left many DeFi tokens with chart patterns that resemble those that were seen by countless altcoins during the 2017/2018 ICO boom. Analysts have even joked that some charts look like Dubai’s iconic Burj Khalifa tower, which is effectively a huge spike in the sky.

Liquidating DeFi Rug Pulls

Popular analyst Josh Rager recently posted how he has just liquidated a large stash of these assets which are now worth a pittance.

Just sold $15k worth of rug pulled assets for less than $20

Using the losses to count against capital gains for tax purposes this year

Something to talk to your accountant about if you got rug pulled too

— Josh Rager