Ethereum Locked in DeFi Soars to a Fresh ATH

Crypto is probably one of the fastest moving space in the world. Its eras are defined by the most popular yearly trends that dominate the headlines. And 2020 could potentially be the year of decentralized finance [DeFi]. The current DeFi mania is often touted as the next evolution of financial markets space. It has continued to The post Ethereum Locked in DeFi Soars to a Fresh ATH appeared first on Coingape.

Crypto is probably one of the fastest moving space in the world. Its eras are defined by the most popular yearly trends that dominate the headlines. And 2020 could potentially be the year of decentralized finance [DeFi]. The current DeFi mania is often touted as the next evolution of financial markets space. It has continued to attract many traders as the money kept pouring in, which has resulted in the honeypot growing exponentially.

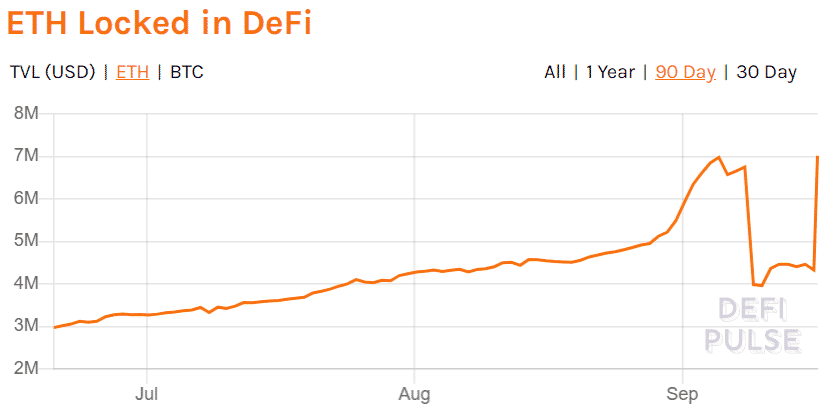

In the latest development, Ethereum locked in DeFi has surged to an all-time high of 7.018 million, according to the DeFi metrics provider, Defi Pulse. This coincided with the recent consolidation of the largest altcoin which was trading close to $400.

Following the major pullback in the first week of September, Ether’s price dropped to $319-level. During the same time, the figures for ETH locked in DeFi fell from its previous ATH of 6.97 million ETH to 3.98 million ETH, meaning a drop of more than 42% in less than a week.

However, as the price headed for recovery, the figures also made a comeback surging all the way to a new high. Interestingly, as opposed to the price movement of Ether, which had been gradual, the latest uptrend with respect to ETH locked in DeFi was observed to be sharp. The figures increased by 62.45% in less than 24 hours.

Meanwhile, the total valued locked [USD] has also noted an uptick after it surged to $8.856 billion along with Bitcoin locked in DeFi which appeared to be hovering close to its ATH at 99.833K.

What does it mean for the coin’s value?

The latest development could potentially signal a macro bullish outlook on the cryptocurrency’s price movement in the near-term. Adoption in decentralized finance does not necessarily translate to the coin’s bullish price action.

However, as more Ether gets locked in various DeFi platforms, a subsequent supply crunch could come into the picture, which in turn, could be a factor contributing to the coin’s demand and hence, a potential rise in Ether’s price in the coming days.

Another Bubble or Investment Opportunity?

Many market commentators have criticized the space claiming it to be fueled by FOMO. However, Former Messari Head of Product and popular crypto trader Qiao Wang was optimistic about DeFi’s growing popularity.

Earlier, he tweeted,

“From an investment point of view, BTC pre-2013 and ETH pre-2015 were once-in-a-lifetime asymmetric bets. DeFi pre-2021 is once-in-a-decade IMO (until proven wrong). If you’ve missed the first two don’t miss the latter.”

Wang added,

“There was a lot of crap over the past 2 months but don’t get distracted by these. Try a dozen of real products and you’ll get a better sense of how DeFi enables fundamentally new and interesting user behaviours.”

The post Ethereum Locked in DeFi Soars to a Fresh ATH appeared first on Coingape.

![DeFi Player Synthetix [SNX] Announces Transition to “Optimistic Ethereum”](../wp-content/uploads/2020/09/25180733/wood-floor-feet-number-city-urban-953611-pxhere.com_.jpg)