Despite Minor Sell-Offs, Bitcoin [BTC] Inches Closer to $14K, What’s Next?

Bitcoin has been riding quite high of late. Despite a rather dull performance by Ethereum and the rest of the altcoin market, Bitcoin has shown clear bullish signs and was currently up by 12.39% over the last week. It was being traded at $13,588, at the time of writing which marked a new 16-month high The post Despite Minor Sell-Offs, Bitcoin [BTC] Inches Closer to $14K, What’s Next? appeared first on Coingape.

![Despite Minor Sell-Offs, Bitcoin [BTC] Inches Closer to $14K, What’s Next?](../wp-content/uploads/2020/10/12120443/bitcoinprice.jpg)

Bitcoin has been riding quite high of late. Despite a rather dull performance by Ethereum and the rest of the altcoin market, Bitcoin has shown clear bullish signs and was currently up by 12.39% over the last week. It was being traded at $13,588, at the time of writing which marked a new 16-month high for the world’s largest cryptocurrency.

A crucial level of resistance for Bitcoin now stood at $14,000, a level that was last seen in the second week of January 2018. If it manages to break this mark, BTC could soar higher and target its ATH level close to $20,000. However, if this coveted level is breached, it could potentially hit $65,000-$80,000 by mid-2021. This bold price prediction was made by one of the most interesting and popular strategist, who goes by the name ‘Magic Poop Cannon’.

If BTC rises above 14,000, it will challenge the all time high at 20,000. If that is broken (which I believe it would be) we could see BTC hit 65,000-80,000 by mid 2021.

— MAGIC (@MagicPoopCannon) October 27, 2020

One of the most prominent reasons for Bitcoin’s immense success was the massive institutional foray. MicroStrategy, for one, happens to be one of the largest publicly traded business intelligence firms in the world. The company made a series of huge purchases in Bitcoin in August and September this year. With the latest gains, MicroStrategy was currently sitting on more than $89,000,000 in profit from its BTC investments.

MicroStrategy investment on #Bitcoin is alreay sitting on +$89,000,000 profit.

— Crypto Rand (@crypto_rand) October 27, 2020

Michael Saylor, the Chief Executive of MicroStrategy had earlier asserted that Bitcoin was a better store-of-value asset class than fiat currencies. This comment was made in the backdrop of the company purchasing 21,454 Bitcoins at an aggregate purchase price of $250 million. Noting the growing pandemic-triggered havoc and the global economy taking a plunge, Saylor had earlier stated,

“Since its inception over a decade ago, Bitcoin has emerged as a significant addition to the global financial system, with characteristics that are useful to both individuals and institutions. MicroStrategy has recognized Bitcoin as a legitimate investment asset that can be superior to cash and accordingly has made Bitcoin the principal holding in its treasury reserve strategy”

Is A Setback Ahead?

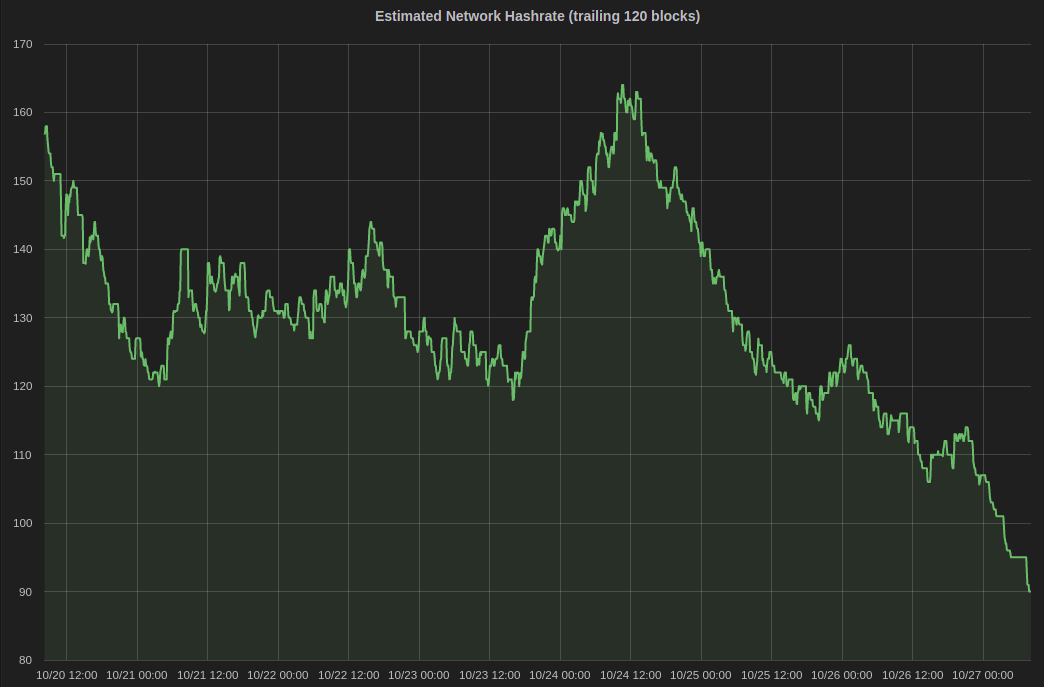

Despite the surging price, there is one setback. Bitcoin’s hash rate which saw a drop of 45% over the past three days. This could be attributed to the end of the rainy season in China’s Sichuan province. Here, the Bitcoin miners seasonally migrate to obtain the benefits of cheap hydro-electric power primarily because rains cause an increase in water levels which, in turn, profits BTC miners’. However, the end of the rainy season essentially meant that the miners are likely to leave.

Having said that, other on-chain data of Bitcoin appeared optimistic with no signs of investor trepidation. This was further validated by the increasing number of Bitcoin whale addresses as unrealized profits recently touched its yearly highs.

The post Despite Minor Sell-Offs, Bitcoin [BTC] Inches Closer to $14K, What’s Next? appeared first on Coingape.

![Bitcoin [BTC] Miners Start A Selling Spree, Is A Sharp Sell-Off Ahead?](../wp-content/uploads/2020/11/03182504/Bitcoin-mining.jpg)